Buying Guides

Is It Time To Buy a House?

Thomas P, Senior Editor

8 July 2020

Deciding when to buy a house can be a big undertaking. Is it the right time in your life? Is it the right time to purchase a home given the real estate market timing? Buying a home may very well be the biggest purchase you will ever make. This huge life event may significantly impact your personal finances, so getting this right is paramount! We think it’s time to buy a house given all the advantages. However, understanding if home ownership is right for you at this given time is the big question.

First, is homeownership for you? There are major advantages, and disadvantages to owning a home.

Home Ownership Advantages

It’s widely accepted that most people should buy a home at some point in their life, though knowing if it is the right time to make a home purchase is pretty critical. Is it the right time to buy a home in your life? Let’s consider some advantages, shall we?

Owning your own home is typically less expensive than renting or leasing.

I think it’s fair to say most of us take the roof over our heads for granted sometimes. Well, unless we don’t have one, or are paying for that roof ourselves. Gosh, remember that first apartment, townhouse, or dorm room when you finally left the nest? Sure, made us appreciate the great arrangement we had before. That being said, if you are paying a few hundred dollars for your rent per month, that monthly expense may not seem so terrible given the hefty sticker price of most mid to higher-priced homes in the United States. These numbers could be anywhere from $150,000 to $350,000 or more in Michigan and other parts of the US…. This could offer a little sticker shock to the first-time homebuyer.

Buying a Home will become one of the largest investments you’ll make.

Let’s look at it this way. To calculate the price of a home you can afford taking into account your current rent or lease payment (given this payment is comfortable for you and your finances), we take your monthly rent/lease and multiply this number by “200”. This, in most cases, should compute to the price of a home in your same monthly housing expense range.

Example: $750 per Month X 200 = $ 150,000

So, if one were to be paying $750 per month for rent/lease, you would approximately pay the same amount per month to own a house that costs $150,000. Considering this, your rent is not exactly cheap compared to owning your own home, is it?!

“It’s widely accepted that most people should buy a home at some point in their life, though knowing if it is the right time to make a home purchase is pretty critical. “

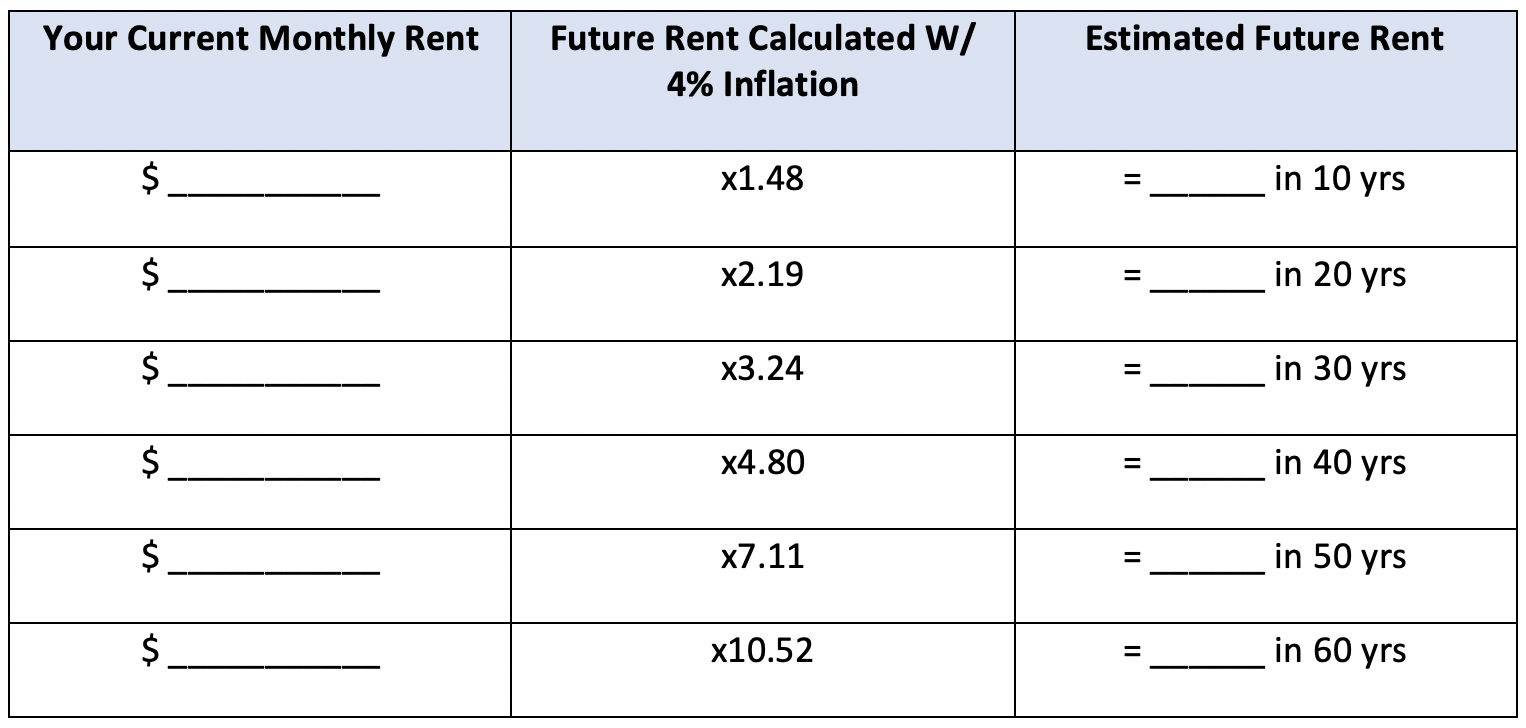

Something else for you to consider, are not only the costs today, but the costs of living tomorrow! Your rent is subject to adjust to the cost of living and inflation. It is believed that an appropriate estimate of this increase is approximately 4% per year. So, early in life, this may not seem like a significant hindrance. However, consider paying that $750 per month as in our example, in 30 years that payment could skyrocket to $2,430!

Consider the following table:

Multiplication factor determining your rent for future years with a 4% increase.

Yes yes, we know homeownership is expensive too… There are many additional costs to owning your own home, including insurance, improvement costs, maintenance costs, and taxes to include a few… However, owning your own home typically isn’t subject to these kinds of inflation costs if you are using a fixed mortgage rate.

In most cases, we all need a place to call home. Given the above calculations, owning your own home can avoid these inflated living costs that have been around for decades. Therefore, in most cases, you will come out ahead significantly given your home is structurally sound and maintained properly. The cheap and convenient renting scenario now will most certainly compound over a long period of time. Does this particularly mean everyone should own a home because of this factor alone? No, not necessarily, but if you do plan on renting for a long period of time, planning your financial plan accordingly is crucial.

Your Home, Your Castle!

One of the advantages of owning your own home is that it’s yours! You can avoid unpleasant landlords. Unless you are subject to the whims of a “honey to-do list”, you are not dictated to what you can and cannot do with your home (in most cases, apart from various homeowners associations, etc.). This is a significant reason to purchase a home! Landlords may be slow to fix problems or make improvements on rental properties. Or, these “improvements” are ether not to your standard or liking. There could be a factor of maximizing profits here. When you own your home, you can get that leaking sink or ugly ceiling painted on your terms, on your standards. However, in retrospect, you are responsible for those associated costs. Even if you are hiring contractors to do work on your home, you are responsible for those costs and go through the stressful selection to ensure you are hiring a good company to take care of your hard-earned investment. Another aspect to consider is you are subject to your landlords’ motivation to sell the property or not. Leaving you the scenario to find another rental property to call home and investing time and money in making your own with associated moving costs and hassle.

You can make your own home yours. In most cases, landlords will limit your ability and creative flexibility on improvements and cosmetic alterations. Moreover, any improvements you are making to that rental property are investments you will not see a financial return on. You don’t own the property after all. Making home improvements on your own home may increase the property value, hence the ability to see a financial return if you chose to sell your property at a later date. That being said, don’t go too much over the top if you think you may sell in the future! You want to make sure your improvements will appeal to future buyers, and they might not agree with your bright pink walls and shag carpet!

Have you seen the Tom Hanks 80’s movie Money Pit!? If you have or haven’t, don’t let this be you! Sometimes, home improvements can get out of control with significant financial investment. These can at times create significant debt that one may not be able to recoup! Always be conscious of these investments. Do your research, and If need be, consult a professional.

Timing is everything, and one needs to make sure you qualify for this endeavor. Is your income adequate? Do you need to work on that credit score? We highly recommend contacting a lender as soon as possible, before you contact a real estate agent. Get a pre-qualified finance letter, know your budget, and communicate this with your agent.

The Advantages of Renting/Leasing

It is our opinion that buying and owning your own home makes the most financial sense in most cases and for most people eventually. However, this doesn’t necessarily apply to all people obviously. For some, renting makes more sense, as there are many advantages to renting.

It’s Convenient

Once the daunting task of finding a suitable home to rent is over that suits all of your preferences, including the area and landlord situation, that landlord is the financially responsible one for all of the fixes and improvements of that home moving forward (in most cases). Plumbing, heating, cooling, leaks, you name it, that landlord is responsible to maintain their property. Typically, all of the hassle to fix, and the associated costs are left to the property owner. This makes things much simpler and convenient for tenants.

Its Flexible long term

If you are someone who is in a situation where you cannot be tied down to one area over a long period of time, well renting makes more sense here. In addition, there are others that just prefer this flexibility to change things up and have the ability to move once the rental or leasing contract has concluded. If you own your home and you are now in a situation where you must move, you now either have that extra cost, or one must sell or rent the property out.

It’s Simple

Like we said above, finding a rental home may be a hassle to fit all of your preferences. However, it is typically a much easier and simple process than finding a home to buy that comes with the associated purchasing costs and considerations. Purchasing your home typically involves finding and qualifying for financing (if not paying cash), have subsequent inspections, appraisals, and an abundance of other aspects renters do not have to consider. These home buying requirements can take a significant time, where some do not have the luxury of time. Renters can typically qualify and move in quickly, at a fraction of the time it takes to find and purchase a home.

Timing and Cost Considerations

Maybe you live in or are moving to an area where there have been subsequent living cost increases to include the real estate market. Maybe the timing in the market is not right taking into account the external environment such as the economy with associated interest rates etc. Purchasing a home costs a lot of money for extra expenses such as insurance, inspections, commissions, loan fees, etc. Therefore, if you do not plan on being in the property for a few years to recoup these costs, purchasing a home may not make financial sense at this time.

Moreover, purchasing a home takes big bucks. Unless you are incredibly financially secure, most people are stretched pretty thin when purchasing a home. Renting keeps these dollars in your pocket for another day or other investments.

Is It Time?

Buying a home is one of the most significant financial purchases and or investments one can take. Real estate investment comes with big costs, some risk but also big rewards. You certainly want to make sure everything goes smoothly here. There are many aspects to consider when purchasing a home and we are pumped you have visited MichEstate during your home purchase. Do you have a game plan? Do you know where to start? Once again, we absolutely suggest you contact your financial institution, or a lending company to pre-qualify your buying

Recent Comments